[ad_1]

Brookfiled has extended the share purchase agreement to buy the IL&FS headquarters in a ₹1,080-crore deal until June after the initial deadline lapsed, said two people aware of the development. “Brookfield has extended the share purchase agreement by six months from December to June given the delays in closing the deal,” said a source aware of the move. “Brookfield wants to close the deal but it is getting delayed due to litigation.”

A Brookfield spokesperson did not respond to a request for comment while an IL&FS spokesperson declined to comment.

Project Holdings Seven (DIFC), which is an affiliate of Brookfield, had signed the agreement for 12,651.95 square meters land at plot No C-22, in the ‘G’ Block of Bandra Kurla Complex, Mumbai, together with the IL&FS Financial Centre in December 2021.

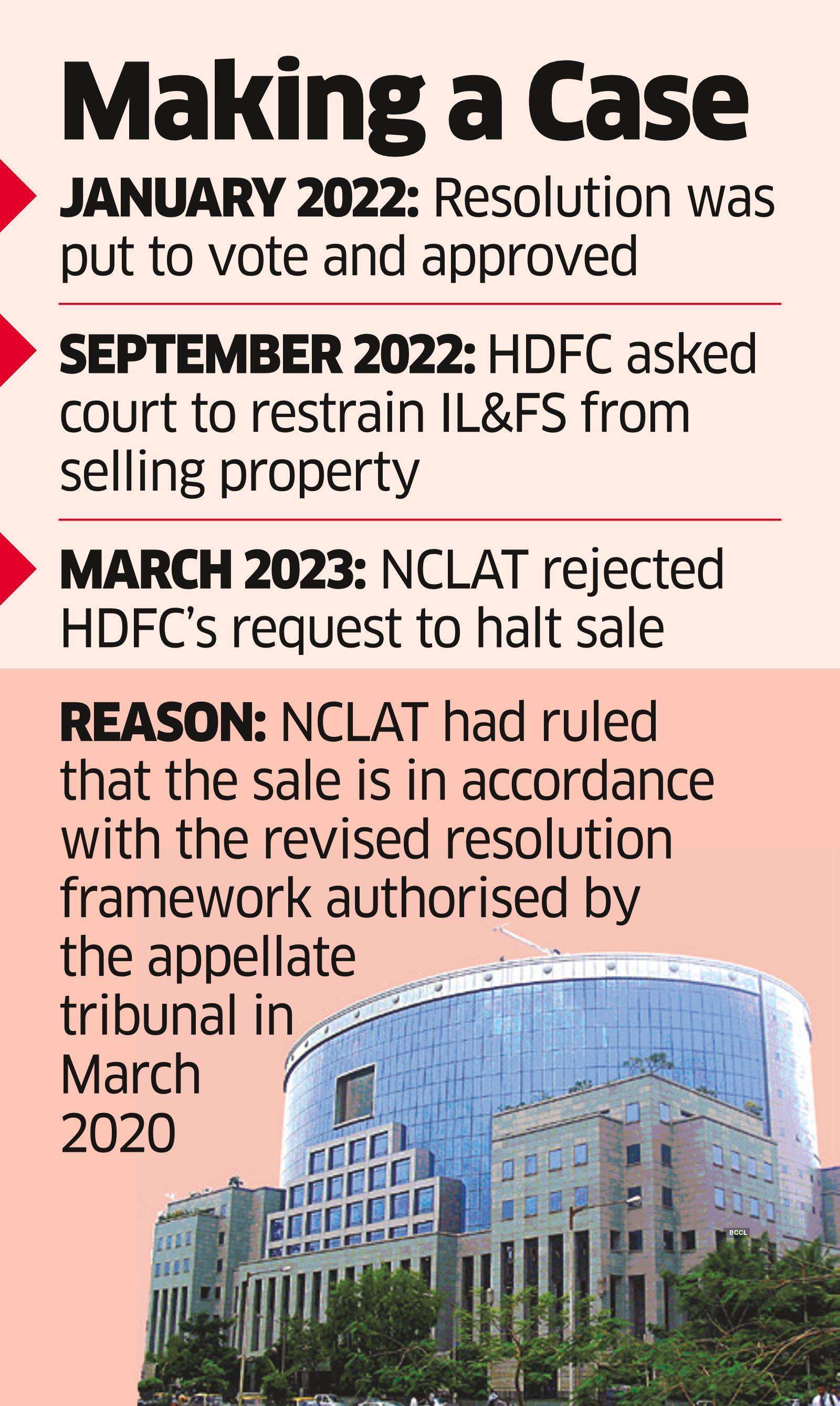

In January 2022, the resolution was put to vote and approved by 73.57% votes by the committee of creditors. However, in September 2022, mortgage lending major HDFC asked the court to restrain IL&FS from selling the property.

Earlier this month, the National Company Law Appellate Tribunal (NCLAT) rejected HDFC’s request to halt sale, saying sale is in accordance with revised resolution framework authorized by appellate tribunal in March 2020 and cannot be a hindrance to approving proposal.

HDFC is likely to file a petition in the Supreme Court of India against the deal, as reported. The matter pertains to ₹400-crore loan by HDFC to IL&FS through a lease rental discounting transaction.

The loan was to be paid back from cash flows generated by IL&FS, which assigned its cash flows to HDFC. But, the company’s new management decided to sell the property as part of plan to reduce its debt.

The adjudicating authority approved the sale on September 23, 2022. HDFC challenged the decision, alleging that it violated principles of natural justice.

“Given the legal delays in closing the deal for Brookfield, coupled with the appreciation in the real estate sector in the last few quarters, there may be an opportunity for lenders to get a revised offer for the asset,” the first source said.

[ad_2]

Source link