[ad_1]

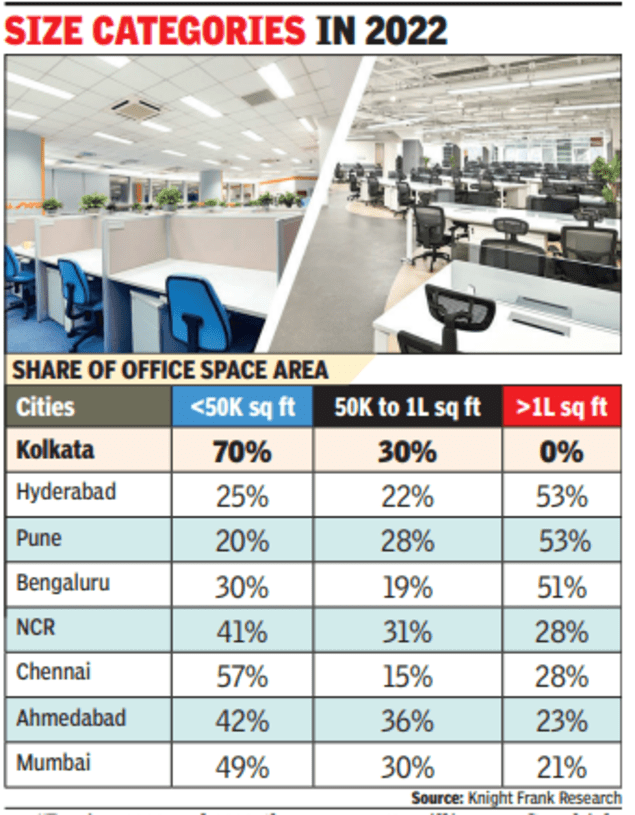

KOLKATA: In Kolkata, nine out of 10 office space deals were for properties below 50,000 sq ft in 2022. Only one out of 10 was in the 50,000-1 lakh sq ft size with none exceeding 1 lakh sq ft.

Overall office space demand witnessed in the city grew from a little over 0.8 m sq ft in 2021 to over 1.1 m sq ft in 2022, a growth of 42% year-on-year.

Real estate consultancy firm Knight Frank India that conducted the study revealed that in Kolkata, the 57 deals in under 50,000 sq ft office space comprised 70% of floor space transactions that happened during the year with the remaining five deals of 50,000-1 lakh sq ft making for the remaining 30%. In 2021, around 84% of the floor space transactions were below 50,000 sq ft category with just 16% in the 50,000 sq ft to 1 lakh sq ft bracket.

In percentage terms, Kolkata clocked the highest ratio of small office space transactions, followed by Chennai at 57% and Mumbai at 49%. The highest number of small office deals though was in Bengaluru at 247, followed by 185 in Pune.

Knight Frank India senior director (east) Abhijit Das said the office space demand in Kolkata has strengthened steadily in 2022 to clock the highest office space leasing total in the past three years.

Pan-India, office leasing volumes in 2022 recorded at over 51 million sq ft, which was historically the second best.

“Within this, IT/ITeS driven markets of Bengaluru, Hyderabad and Pune, saw more than 50% of their total office leasing by occupiers taking in excess of 100,000 sq ft. The large space take up are usually for value driven services such as R&D and GCCs, which is a sign of India’s continued prowess in this area. We expect the momentum of office transaction to remain largely in line for 2023,” said Knight Frank India chairman and managing director Shishir Baijal.

[ad_2]

Source link