[ad_1]

Singapore sovereign wealth fund GIC has acquired an information technology-special economic zone (IT-SEZ) spread over 1.1 million sq ft in Hyderabad‘s Gachibowli locality from the Phoenix Group for ₹1,050 crore, said persons with direct knowledge of the development.

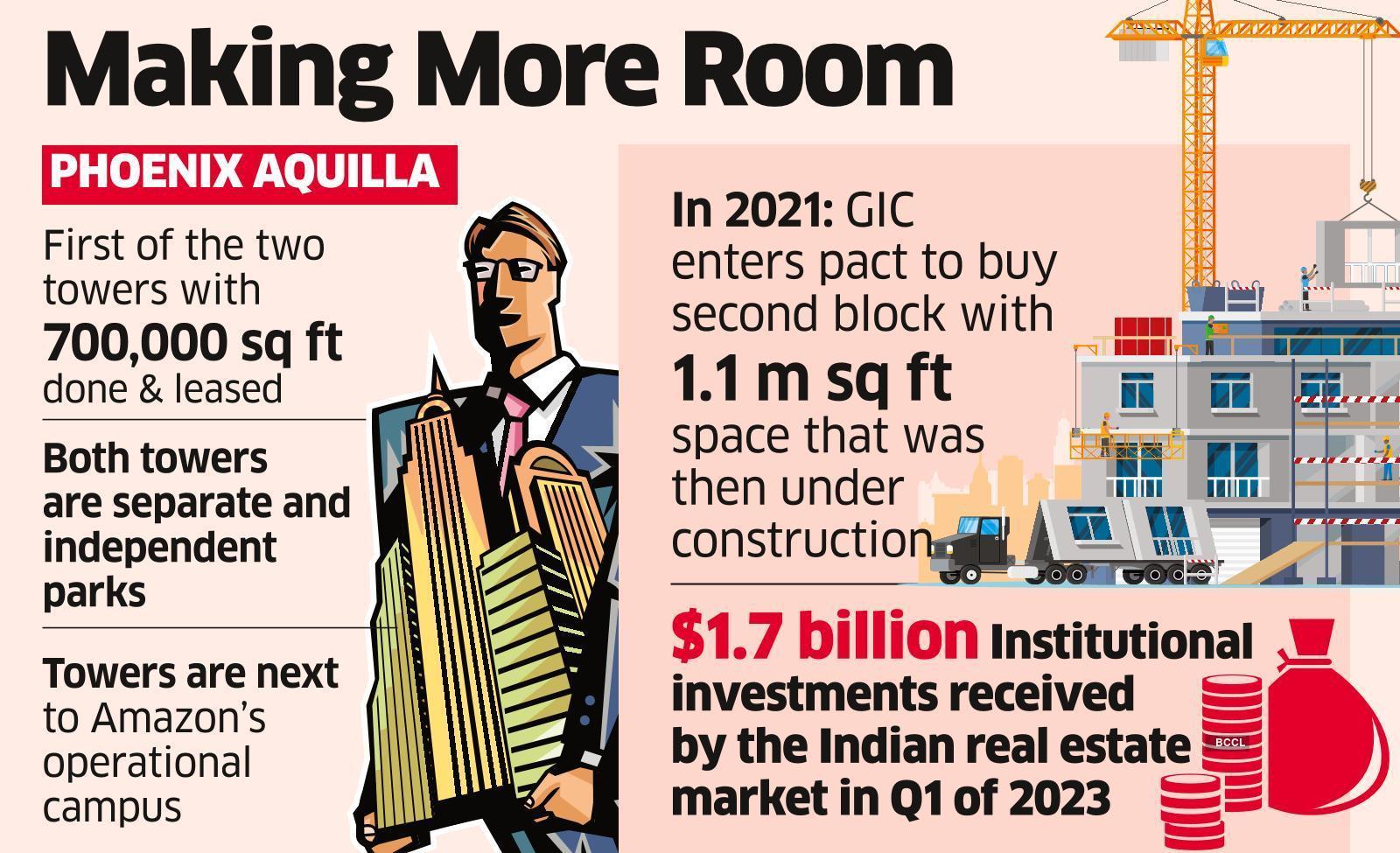

The entire development, Phoenix Aquilla, has two towers spread over 1.8 million sq ft, and the first tower with 700,000 sq ft has already been completed and leased. Both the towers, next to Amazon’s operational campus, are separate and independent parks.

In 2021, GIC entered into a forward purchase agreement to buy the second block with 1.1 million sq ft space that was then under construction and is now completed. In 2020, in one of the single most significant leasing transactions in the country, this entire IT park was pre-leased to American IT major Micron Technologies.

“GIC had paid part of the consideration amount upfront, and the balance has now been paid with the project’s handover,” said one of the persons mentioned above.

ET’s email query to GIC remained unanswered until press time, while Phoenix Group and transaction advisor CBRE South Asia declined to comment on the story.

Last week, ET reported that GIC has emerged as the frontrunner to acquire Allianz and Shapoorji Pallonji Group entity’s joint asset, IT special economic zone Waverock, spread over nearly 2.5 million sq ft in Hyderabad for around ₹₹2,000 crore. This property is also in the close proximity to the Phoenix Group’s IT SEZ.

Foreign investments in India have been on the rise over the last few years as the industry underwent an overhaul, with major structural, policy reforms inducing transparency and ease of business operations, according to a Colliers India report.

Global and domestic funds like Blackstone, Brookfield, CPPIB, Kotak and Motilal Oswal have been active in deploying money across asset classes. These firms are looking and acquiring marquee assets in the Indian office segment, while other asset classes like residential, industrial warehousing and data centres have also shown promise to investors.

Institutional investments in real estate continue to remain upbeat in the March quarter as well.

The Indian real estate market received strong institutional investments totalling $1.7 billion during the first quarter of 2023, with the office sector leading the way and providing a positive outlook for the year ahead, with investment inflows in the office sector rising by 41% from a year ago to $0.9 billion, led by select large deals.

[ad_2]

Source link