[ad_1]

CHENNAI | BENGALURU: The IT services sector is slowing down on real estate absorption due to a combination of weakening business, adoption of a hybrid work model, and re-allocation of talent to tier-2 satellite offices.

However, that slack is being picked up by global capability centres (GCCs) of MNCs and product firms – companies whose numbers are growing and who seem more particular about in-person collaboration. GCCs are offshore units that provide support services like IT, finance and analytics to their parent organisations.

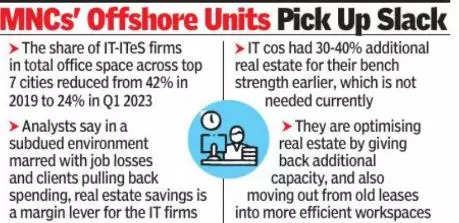

Data from property research firm Anarock shows that the share of IT-ITeS (IT-enabled services) firms in total office space across the seven major cities reduced about 24% in Q1 2023 from 42% in 2019. Simultaneously, there is a rise in the share of GCCs.

“Over 200 million sqft of commercial stock in India is currently occupied by GCCs and 500 new MNCs are expected to enter India and set up capability centres,” Anarock chairman Anuj Puri said.

Among IT services firms, Cognizant has been the most aggressive in attempting to cut real estate costs. At an investor conference, Cognizant CEO Ravi Kumar said he plans to knock down 80,000 seats in big cities, and repurpose a part of it to tier-2 cities.

“The hypothesis is not everybody’s going to come back to physical work,” he said. Real estate major DLF, in its earnings call last week, said Cognizant has given up 30-35% space (with DLF) in Chennai over a few years.

Analysts say realty savings is a significant margin lever for IT firms in the current subdued environment. Real estate accounts for 15-20% of costs at IT majors. “Real estate is a big component of the FTE cost and clients expect lower or flat costs to make the business case attractive,” Phil Fersht, CEO of IT advisory HfS Research, said.

Ritesh Sachdev, SVP & head of commercial leasing and asset management at Tata Realty and Infrastructure, said IT firms used to have 30-40% additional real estate for their bench strength earlier, but that’s not needed today. Ritwik Bhattacharjee, chief investment officer of Embassy REIT, said Indian office demand is today led by global captives.

Anarock’s Puri also noted a reduced dependence on traditional IT players. The ‘China plus’ sentiment has created opportunities for manufacturing and industrial segments, and the share of real estate absorption by these two sectors has more than doubled, he said.

[ad_2]

Source link