[ad_1]

RBI Governor Shaktikanta Das, who was chosen for the prestigious Governor of the Year Award 2023 earlier this year, has said that central banks at the core of monetary and financial systems have been called to do “heavy lifting” well beyond their traditional mandate.

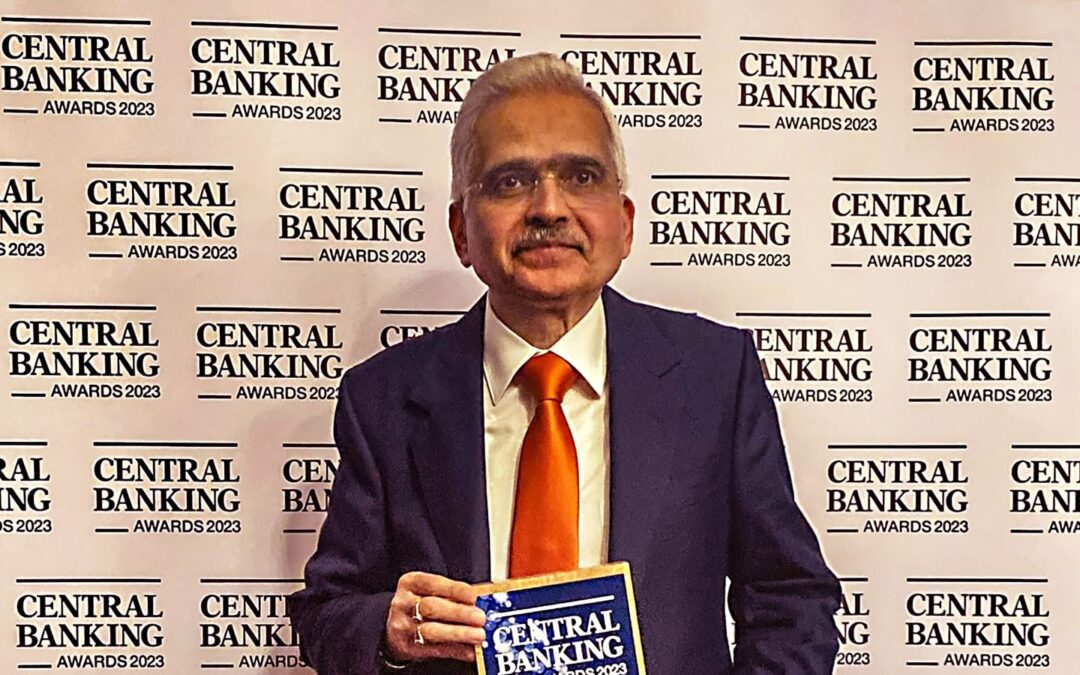

Das was conferred the award by ‘Central Banking’ which definitively covers and analyses issues around the world’s central banks and financial regulators following the summer meetings of the organisation in London on Tuesday.

When the award was announced in March, the organisers said that the Reserve Bank of India Governor is being honoured because he has cemented critical reforms, overseen world-leading payments innovation and steered India through difficult times with a steady hand and well-crafted turn of phrase.

“COVID had a devastating impact worldwide, and densely populated India looked particularly vulnerable. It was in managing this crisis that Das had perhaps his greatest impact, appearing as a voice of calm amid the fear, and steering the RBI deftly between intense political pressures on one side and economic disaster on the other,” ‘Central Banking’ said in a statement.

“COVID-19 was no doubt the biggest crisis Das has faced so far as RBI chief. But his tenure, which began in December 2018, has been marked by a series of grave challenges, starting with the collapse of a major non-bank firm, moving through the first and second waves of the coronavirus, and then, in 2022, Russia’s invasion of Ukraine and its inflationary impact,” it said.

In his plenary address entitled ‘Central Banking in Uncertain Times: The Indian Experience’ on Tuesday, Das, 66, noted how central banks as at the core of monetary and financial systems have been called to do “heavy lifting” well beyond their traditional mandate.

“Central banks have navigated through unchartered waters during the three black swan events – the pandemic, the war in Ukraine and the unprecedented scale and pace of global monetary policy normalisation – all in the span of three years. More recently, central banks had to quickly change gears from providing stimulus to pandemic-ravaged economies to battling inflation with all ammunition at their disposal,” he said.

Speaking on monetary policy in India, he cautioned that the cumulative impact of monetary policy actions over the last one year is still unfolding and has yet to materialise fully.

He noted: “While our inflation projection for the current financial year 2023-24 is lower at 5.1 per cent, it would still be well above the target. As per our current assessment, the disinflation process is likely to be slow and protracted with convergence to the inflation target of 4 per cent being achieved over the medium-term.

“Based on this realisation and with a view to assessing the impact of past actions, we decided on a pause in the April and June 2023 meetings, but clarified unequivocally that this is not a pivot – not a definitive change in policy direction. Recognising that explicit guidance in a rate tightening cycle is inherently fraught with risks, the MPC [Monetary Policy Committee] has also eschewed from providing any future guidance on the timing and level of the terminal rate.”

[ad_2]

Source link